2024 Mileage Rate Calculator For Government Employees. To calculate vehicle allowance amounts provided by employers using the cra mileage rate, multiply an employee’s total business kilometres driven during a given tax year with the corresponding kilometric rate of ($0.70. You can calculate car and car fuel benefits by using our interactive calculator.

With the updated irs mileage reimbursement rate for 2024, federal employees should adopt best practices for tracking and reporting their business mileage. Especially if they regularly drive long distances and spend money on fuel.

2024 Mileage Rate Calculator For Government Employees Images References :

Source: shaylynnwanthe.pages.dev

Source: shaylynnwanthe.pages.dev

Government Mileage Rate 2024 Calculator Ny Coral Dierdre, For employees who need to use their personal vehicle for government purposes, the reimbursement rates have been updated since.

Source: linniewlou.pages.dev

Source: linniewlou.pages.dev

Irs Reimbursement Rate For Mileage 2024 Livvy Quentin, Gsa establishes the rates that federal agencies use to reimburse their employees for lodging and meals and incidental expenses incurred while on official travel.

Source: viviyanwdebee.pages.dev

Source: viviyanwdebee.pages.dev

Government Rate For Mileage 2024 Lilia Cathleen, What is the federal mileage reimbursement rate?

.png) Source: lanitawbrana.pages.dev

Source: lanitawbrana.pages.dev

Mileage Calculator 2024 California Kandy Loreen, Having employees use their own vehicle for work can be expensive.

Source: alisonbcorabella.pages.dev

Source: alisonbcorabella.pages.dev

2024 Mileage Rate Calculator Ireland Lana Shanna, For calculating the mileage difference between airports, please visit the u.s.

Source: jammievkrissie.pages.dev

Source: jammievkrissie.pages.dev

Per Diem Rates 2024 Mileage Calculator Sybyl Eustacia, Gsa has adjusted all pov mileage reimbursement rates effective january 1, 2024.

Source: karonqlorene.pages.dev

Source: karonqlorene.pages.dev

Mileage Rate 2024 Kenya Oona Torrie, Now you can quickly calculate.

Source: lakeishaaliha.blogspot.com

Source: lakeishaaliha.blogspot.com

Gross profit calculation example LakeishaAliha, Plan a trip research and prepare for.

Source: www.taxuni.com

Source: www.taxuni.com

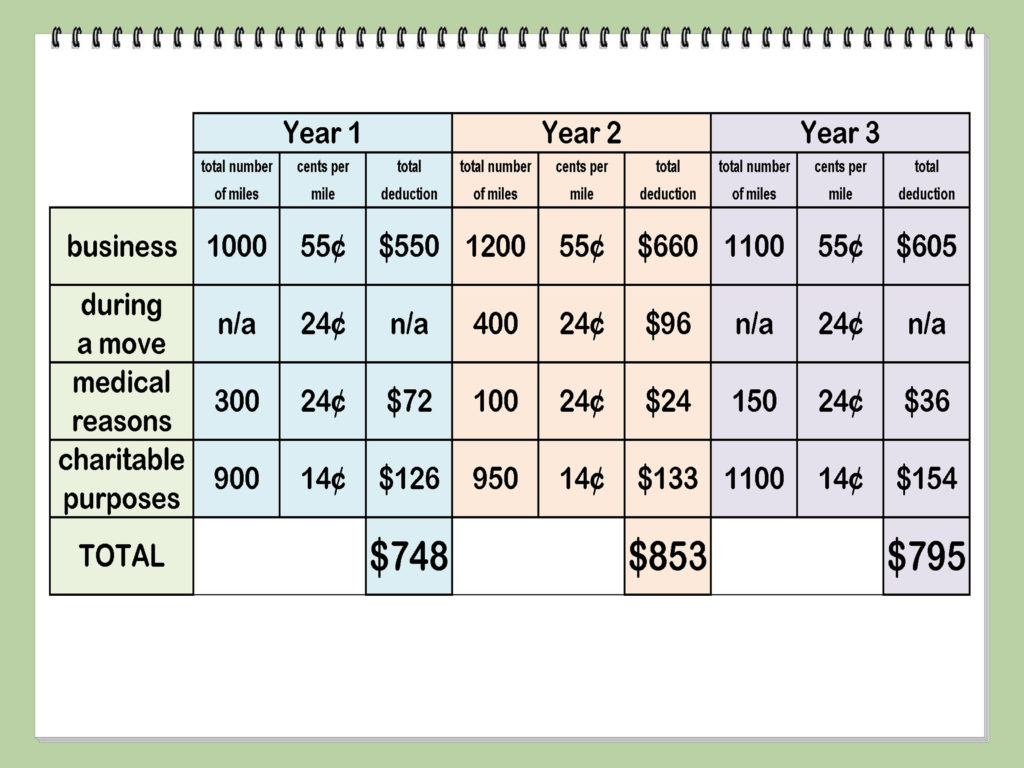

IRS Mileage Rate 2023, Mileage claims made in respect of.